24th August 2018

24th August 2018

Some ports serving Intra-Asia trades have become victims of their own success as growing volumes have led to congestion and delays.

The Intra-Asia market is forecast to grow in the range of four to six percent in 2018 when compared to last year, according to research by Seabury & IHS Markit. Growth areas include countries such as Vietnam, Malaysia and the Philippines. Ports that are well-positioned to serve the Intra-Asia trade are those with sources of cargo and a well-established network. Flexibility and capability to cater to the Intra-Asia trade would carry more weight than infrastructure and equipment, although having the appropriate infrastructure and equipment would be a prerequisite.

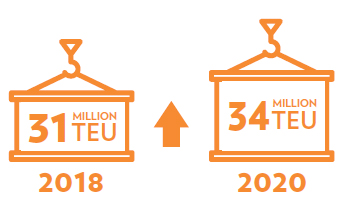

In total, Intra-Asia container volumes are set to rise from around 31 million TEU this year, climbing to around 34 million in 2020, according to IHS Markit forecasts.

In total, Intra-Asia container volumes are set to rise from around 31 million TEU this year, climbing to around 34 million in 2020, according to IHS Markit forecasts.

“The signs of growth in the region are encouraging,” said Changyong Rhee, Director of Asia and Pacific Department at the IMF. “The challenge now is to strengthen and sustain this momentum,” he told JOC.com.

Certain commodities are seeing particularly strong growth, for instance a twenty percent increase in waste products, partly as a consequence of recent waste import restrictions into China, resulting in demand for new locations within Asia for waste handling. Raw materials and industrial consumables are also expected to grow strongly at about five percent, reflecting Asia’s continued importance in manufacturing and production.

“The Intra-Asia trade is a complex and fast-moving trade with particular characteristics,” said Helen Li, Head of Research and Analysis, Group Commercial at Hutchison Ports. These trade characteristics include:

“Because of the nature of the Intra-Asia trade, the requirements it places on ports and terminals is the need for flexibility and efficiency. This creates challenges to terminal operations in yard shuffling needs, as well as transhipment and operational complexity,” Li added.

Port congestion at smaller Asian ports resulted in delays of up to seven days, earlier this year.

Some Intra-Asia carriers have said Bangkok, Chittagong, Kolkata, and Shanghai are among the worst affected ports, with berthing delays of almost a week. While part of the problem has been caused by growing container volumes, carriers also point to inefficient operations and inadequate infrastructure exacerbated by bad and unstable weather conditions, particularly in eastern China.

Equipment has come under the spotlight and the lack of availability of quay cranes at many smaller Asian ports, which reduces the number of box moves per hour, results in even further delays.

However, handling smaller vessels also restricts the number of cranes that can be deployed.

“Vessels catering specifically to the Intra-Asia trade are relatively smaller than those deployed on the main trades. The smaller vessel sizes and shorter vessel lengths of Intra-Asia vessels (approximately 1,500 TEU) makes it more difficult for terminals to achieve higher productivity, because operators would not be able to deploy as many cranes to service these smaller vessels,” Li said.

“In addition, these Intra-Asia vessels may not necessarily require as many crane moves, which affects operational efficiency as the time required for berthing and unberthing would still be similar despite the relatively lower volume of moves.”

Unlike most ports, Chittagong and Bangkok ports operate berths on a ‘first come, first served’ basis rather than allowing carriers to pre-book a berthing window. There is a total of fifty-seven geared (with on-board cranes) and seven gearless ships registered to call with the Chittagong Port Authority (CPA) at Chittagong.

An evaluation of live ship data in June seems to support this, particularly at Chittagong, where seven of the fifteen container ships at anchor waiting to berth at the port had been anchored for four days or more. Five have been waiting for three days or more, and three have been waiting for two days or more, according to AISLive.

INTRA ASIA TRADE NETWROK

Chittagong has also ordered additional cranes, but they have yet to be commissioned, and while geared vessels can also use the general cargo berth and the new container terminal at Chittagong, there are still delays. The CPA has announced ambitious plans to develop new container terminals plus a deep-sea mega-terminal.

As both Chittagong and Bangkok are river ports, there are draft restrictions, which adds to the difficulties. So-called Chittagong max vessels are limited to a draft of between 6.5 metres and 7 metres, while Bangkok can handle larger ships up to about 9 metres draft.

Bad and unstable weather conditions in China have recently caused carriers significant problems at Shanghai and Ningbo, but weather conditions around Shanghai have improved recently. Intense fog and strong winds affected port operations and vessel services earlier this year in Shanghai, Ningbo, and Qingdao, causing disruptions to normal port operations and resulting in vessel service delays. Port operations at Waigaoqiao and Yangshan (Shanghai) were being delayed by up to three days with limited opening hours for container yards.

To mitigate the time carriers lose to delays caused by congestion, bad weather and the knock-on effect of extended waiting time on other Asian ports, Hutchison Ports works closely with carriers towards improvement in operations planning, handling efficiency and fine-tuning the capabilities required to cater to the needs of customers.

“Our terminals co-ordinate with shipping line customers to make adjustments to the berth plan to spread out the workload as much as possible. We will alert shipping lines in advance to changes in our berthing situation so that they can make the required adjustments to their sailing schedules and port calls accordingly,” said Li.

“We also continue to work with carriers to encourage optimal stowage which would allow shorter vessel turnaround times,” added Li.

Because of the fast-moving nature of the Intra-Asia trade and the requirement from ports to maintain flexibility and efficiency, it is essential for terminal operators to work closely and collaborate with carriers to mitigate delays and to help maintain schedule integrity.

Hutchison Ports is responding to this demand for improved services by expanding its network of state-of-the-art ports and services across Asia to better meet the needs of its regional customers.

“Hutchison Ports has a strong presence in Asia serving the Intra-Asia trade. We are enhancing the capabilities of our facilities across the region, such as the development of Terminal D in Laem Chabang (Thailand), to serve growing volumes,” concluded Li.