16th June 2017

16th June 2017

The world trading environment is entering a new phase of protectionism. In order to boost its own manufacturing sector, US President Donald Trump plans to roll back globalisation and put up barriers to trade. President Trump has threatened to impose a 45% punitive tariff on imports from China and accused China of being a currency manipulator and of stealing jobs from American workers.

Although this rhetoric has softened since Donald Trump met with China’s Premier Xi Jinping, this neo-protectionism will affect the global shipping sector, but this is not a completely new phenomenon, Olaf Merk, Economist at International Transport Forum of the OECD, told OPPORTUNITY magazine. “We have seen an increase in protectionist measures since 2009.” Regarding the latest threat by the Trump administration, he said, “We will have to see if certain statements will indeed be translated in trade barriers at the US border, negotiation of NAFTA (North American Free Trade Agreement) and less reliance on multinational trade agreements. At this moment, there is not much clarity yet on exactly where this is going.”

Underlying this, Merk noted, is a more structural trend of decreasing trade intensity of GDP growth. “One per cent growth in global GDP no longer leads to 3% global trade growth like in the past. The relation is now more one to one. This translates into lower volumes to be shipped.’’

For the last five years, the global economy has been in a low growth trap, with growth disappointingly low and stuck at around 3% per year. In OECD’s Economic Outlook, trade growth is projected to increase from a dismal ratio of global trade-to-GDP growth of around 0.8 to be about on par with global output growth — much less than the multiple of two or three enjoyed over the last few decades.

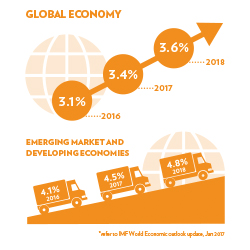

*Global GDP growth is projected to pick up modestly to around 3.6% in 2018, from just 3.1% in 2016, boosted by fiscal initiatives in the major economies, according to the IMF World Economic Outlook Update. Confidence is up, but consumption, investment, trade and productivity are far from strong, with growth slow by past norms and higher inequality.

Asked if Chinese manufacturers would move production to the US, to avoid possible punitive tariffs levied on China, Merk said, “There is a trend of outsourcing of Chinese manufacturing to lower-income countries in the region, such as Vietnam and Indonesia, but punitive tariffs are not likely to bring manufacturing employment back to the US.”

However, due to high costs of labour, resources, energy and transportation in China, some Chinese manufacturers are planning to relocate to the US. For example, China’s “glass king”, Cao Dewang, chairman of Fuyao Glass, recently said even though wages for a factory employee in the US were about eight times higher than for those in China, the US remained an attractive place to invest. Cao has decided to invest – US$1 billion in the US, which includes taking over a former – General Motors plant in Dayton, Ohio.

Several other Chinese companies such as garment manufacturer Tianyuan Garments, which makes clothes for brands such as Adidas, Reebok and Armani, and paper products manufacturer Sun Paper Industry have also decided to invest in the US. The moves are not because of the threat of punitive taxes, as rightly noted by Merk, but because of the high costs in China and the incentives offered by US states.

If Trump makes good his threat of punitive taxes, it would affect transpacific container shipping. “Container shipping has enabled global outsourcing. If outsourcing would be rolled back, shipping would obviously be affected,’’ said Merk. “Developments like 3D-printing and automation of manufacturing in the developed world will likely reduce global containerised trade flows.”

Following the US pull out from the Trans-Pacific Partnership (TPP) agreement, it is very likely that the Regional Comprehensive Economic Partnership (RCEP) agreement, led by China, will replace its rival TPP, said Merk.

The RCEP brings together the 10 members of the Southeast Asian grouping ASEAN plus China, India, Japan, South Korea, Australia and New Zealand, but notably excludes the US, while the TPP includes Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam.

If the RCEP develops into a major grouping, it will be a further boost for intra-Asia trades and it will have an impact on transpacific trades, Merk added.