24th August 2018

24th August 2018

One of the major recurring costs for shipping is finding and repositioning empty containers. The problem has been exacerbated by more complex supply chains and the increased containerisation of traditional bulk cargo.

To give an idea of the scale of the problem The Boston Consulting Group (BCG) estimated that repositioning empty boxes costs the industry US$15-20 billion a year, equivalent to up to eight percent of a carrier’s operating costs at the time of the estimate.

Empty containers made up a quarter of all the box movements in China, twenty-nine percent in Europe and fifteen percent in the United States, BCG said. It added that thirty-three percent of the cost was due to carriers’ operational inefficiencies. In an earlier survey, maritime consultant Drewry said repositioning an empty container costs a shipping line US$400 per box.

The International Cargo Handling Association (ICHCA) is a nerve centre for all aspects of container shipping and the message is that there are fundamental reasons for the number of empty containers such as the imbalance in trade between East and West.

Richard Brough, ICHCA Technical Advisor said, “If you look at China-UK trade we have twenty foot containers inbound and forty foot containers on the outbound leg, immediately you have an imbalance and spare container capacity heading for Asia,”

“The other more recent development is that many waste products such as brick, rubble, paper, metal and plastic used to be sent in containers from Europe to China and other Asian countries for recycling and landfill. Now China has banned the import of these products and other Asian countries are following suit, there has been an increase in empty containers heading back to Asia.”

Given the empty container problem is likely to increase, there is a need to get ahead of the problem. From a ‘hardware’ perspective, containers need to be positioned where they are going to be needed and after use, they are deposited somewhere else.

Asparuh Koev, CEO of Transmetrics, a Bulgaria-based technology company with a catchy slogan ‘Stop Shipping Air’ which encapsulates the endemic problem facing the industry.

“The problem is really to understand where the containers will be needed next in order to ensure the most efficient way to relocate them. And this is obviously a predictive problem, because the time horizon in which customers are booking their shipping orders is shorter than the time horizon needed to reposition containers, so you need to reposition containers before you have a customer order and obviously it’s a difficult problem to solve,” said Koev.

There are some practical solutions to the problem, such as reducing the ‘working stock’ or safety stock that carriers holds at major ports.

“This safety stock can be significantly reduced based on proper demand modelling if you treat it as a statistical prediction problem. As a result, companies could sell off extra containers that they don’t need, they would reduce the congestion of storage space in ports, reduce the amortization costs and so on,” added Koev.

Hutchison Ports for its part works very closely with its customers around the world to find solutions for storage and timely despatch of containers at Hutchison Ports ICAVE terminal in Veracruz, Mexico.

The terminal has invested in a new special facility for container logistics, storage, maintenance and repair services requested by carriers for empty containers. The yard is located at the Logistics Activity Zone (ZAL) which is close to ICAVE terminal and the new port of Veracruz, scheduled to open in late 2019.

“We offer a relocation service for shipping lines moving empty containers from the ZAL to ICAVE terminal based on demand from our customers. There is also space allocated at the terminal for empties arriving by rail or container freight station which helps speed up the process and turnaround time,” said Susana Diaz, General Manager of Hutchison Ports ICAVE.

ICAVE was the first port operator in Mexico to designate a specific area for customers at its terminal for empties which is segregated by shipping line, type and conditions of container.

Technology is also playing an important role at ICAVE, Electronic Data Interchange (EDI) is available to inform customers of different events for empty containers such as ‘gate in’ and ‘gate out’ movements.

“For shippers, we have developed an app named mobilePort which is used by shippers to track the container process, vessels operations and more, to give visibility that make it easier and more efficient for shippers to release containers from the terminal to be returned to the final destination indicated by shipping Line,” said Ms. Diaz.

Inevitably most of the answers are found in the digitisation of the shipping industry, as data can flow more efficiently through the supply chain and more timely decisions can be made and action taken to reduce the ‘down time’ of empty containers.

The digitisation of the supply chain will improve by having better data input. Optimisation of empty containers should be treated both as a predictive problem and part of business process management, so the better and precise the data you can have, the better you can optimise, according to Koev.

But the ‘magic bullet’ is to ensure the quality and accuracy of the data generated is good and from there the industry can move forward.

“The problem with the data is not so much with the transport companies themselves, such as shipping lines who typically generate quite good data, but the problem is with the lower quality data that comes from the shippers. It is sent via various EDI devices, protocols, it is maintained by different systems, so much data is still received by fax and so on. All of these factors negatively affect the data quality and accuracy.”

“And we are talking here about the minimum set of data that you absolutely require in order for the shipping line to accept your order. That is why another big impact for the shipping industry will come from the digitalisation of the freight forwarders that is happening at the moment,” said Koev.

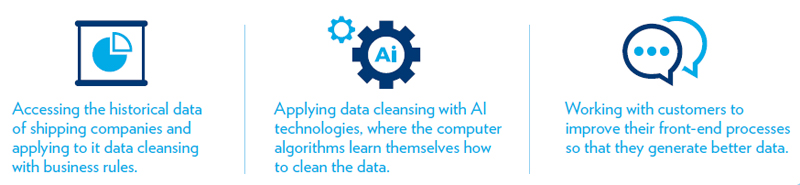

So, if poor data is so widespread in the industry what can be done to ‘clean’ it up and make it fit for purpose?

While finding the physical space to store empty containers and using predictive technology to reduce the number of unused boxes, there is also the ‘matchmaking’ model which looks to ‘hook up’ empty containers with shippers.

With this concept in mind INTTRA, the electronic container shipping platform, has now entered the fray to help rebalance the mismatch between boxes and cargo by expanding the coverage of Avantida, which INTTRA acquired in 2017. Avantida is aimed at truckers, matching empty containers with shippers with products to export.

The system, which saves repositioning costs, time and reduces emissions and port congestion, has been rolled out in eleven European countries and Mexico and is expected to expand to cover North America and Asia later this year.

Longer-term blockchain technology could also offer solutions to track and find wayward boxes while cutting repositioning costs.

However, while trials of blockchain technology have focused on improving the processes involved in shipping goods in containers, there is yet to be a comprehensive blockchain solution for the container shipping industry. Many trials are underway at present and there are positive signs the technology will be a major driver improving efficiency in the empty container sector.

IBM and Maersk have been leading the way in the shipping sector, conducting trials and stress-testing blockchain for shipments of flowers and electrical parts and supermarket giant Walmart has followed suit with pork and fresh produce trials.

Australia Post is working with Alibaba to test the provenance and traceability of food to reduce the incidence of fraud in China and BHP Billiton is using blockchain to securely record and track key sample data in its mining processes.

At the heart of all the potential solutions to reducing the number of empty containers and improving utilisation, is the need for great collaboration between shippers, freight forwarders, shipping lines, ports and government agencies.

For Hutchison Ports, the initiative starts at a local level, such as ICAVE is working together with the Port Community to improve the process.

“We have invited trucking associations, companies and external yards to operate more efficiently to reduce the delays of empty deliveries into the logistics chain. By the end of 2018 we are also planning to develop an electronic platform for shipping lines to check empty containers’ inventory in real time,” concluded Ms. Diaz.